It’s that time of year again! Even though the deadline isn’t until April, I always think of January as tax season, since that’s when the forms start rolling in. I like to get taxes done as soon as possible so I can put the refund money to work.

As I’ve done in past years, I thought I’d share how we’re divvying up our refund this year to make big progress toward our financial goals.

Tax Programs

I’ve heard that TurboTax have ticked off loyal customers by removing functionality from less expensive versions of their program in order to force people to choose a more expensive package. It seems they’ve mostly chased them away to other companies instead. I think if people knew what they are doing with the forms (which the IRS provides for free, of course), they should have been allowed to continue filling in the forms independently without charge. People like myself who are a little less experienced and want the whole “hold my hand” interview thing don’t mind paying the extra cost…or at least we’re willing to.

I do like TurboTax a lot, but for the second year in a row I grabbed H&R Block’s downloadable software when it was a Deal of the Day on Amazon. This year I bought H&R Block Premium & Business for $42.11, with State included. I like TurboTax’s interface a little bit better, but other than that there’s really little difference between the two as far as I’m concerned.

I’ve also heard good things (albeit mostly sponsored things) about TaxAct.com on other blogs, and I know people who use and like TaxSlayer.com. I’m sure there are many other great websites and software packages out there (feel free to let everyone know in the comments). Before you file, know that if you earn less than $60,000 per year, you may be able to file federal (and in some cases, even state) for free — visit the IRS website for details.

Okay, so that’s how I’m doing our taxes. Without further ado, here’s what we’re doing with the money.

Replenishing our Special Occasion Fund

First on the agenda is fully funding our Special Occasion Fund. This is an account I started a few years ago, and it has worked out fantastically well. I sat down and considered all of the special occasions (birthdays, anniversary, holidays) that we spend money on, then set a budget for each. Adding all of these together, I determined the total amount of money we would need for the whole year.

I can’t tell you the peace of mind it provides, particularly at Christmas. No matter what happens in our lives, the money we need to celebrate special days is already taken care of.

This, however, will be the last year we fund that account all at once (more on that in a minute). At the beginning of the year I set up an automatic transfer so that 1/12th of the total amount is deposited into the account each month from our take-home pay. By 2016 the Special Occasion Fund will be full again without waiting for our tax refund.

Topping off our Emergency Fund

Having a fully funded Emergency Fund is something we’ve been working at for a while now. It’s felt like two steps forward and one step back much of the time. Summer and fall of 2014 were particularly tough — at one point both of our vehicles were off the road with issues, our hot water heater croaked, and of course there was the whole replacing the bathroom plumbing thing.

Even when we weren’t dipping into it, the small amounts we could contribute just weren’t making it build up as quickly as I would like, and it felt like we were spinning our wheels when there were so many other things I wanted to save up for instead.

Sometimes you just need a quick win to give you a confidence boost and be able to move forward. A few years ago it was paying my car off in one fell swoop that did it for me. This year we will have enough money to fully fund our Emergency Fund (which, for now, I define as three months of living expenses) for the first time ever! And hopefully it will stay that way for a while.

We do still have a loan for my husband’s car. I can see Dave Ramsey rolling his eyes at me. We’re doing things all out of order. We could have thrown a chunk of money at the car loan, but it wouldn’t have covered all of the balance, and we’d still have a half-funded emergency fund to chip away at over time.

Sometimes you go with the thing that gives you the most peace of mind first. With a family to take care of, the Emergency Fund is it. And, yes, the car payment is factored in. The interest rate on the loan is super low, so I’m not worried about it that much, but it’s definitely lined up in my sights. I can’t wait to be debt free again!

Bye Bye Big Refund

Truth be told, getting a huge tax refund isn’t really a good thing — it means you’re letting the government use all that money, your money, interest-free for a year! Guilty as charged! I did have a couple of reasons though. Maybe not the best reasons, but they were reasons.

First, I had been doing a lot of freelance work as a self-employed individual. We purposely withheld more than we needed to so that my husband’s withholding would cover any self-employment taxes I would owe. Otherwise, I would have to pay quarterly estimated taxes, or a penalty at the end of the year.

And, second, I admit that I just needed a little crutch to make up for my sometime lack of self-discipline, lack of focus, or plain forgetfulness, and having the money out of reach ensured that it wouldn’t be spent on little things throughout the year. It’s easy for me to see what a big lump sum of money can do (and I’m not talking a 2000-inch TV), but harder for me to get excited about smaller amounts.

However, 2015 brought some big changes for us, so we finally decided to adjust our withholding. The biggest change was losing our old health insurance and getting a new plan that costs double what we had been paying. Oh, and it comes with a $3,000 out-of-pocket deductible before it covers 80% of our medical costs. We liked our insurance and we didn’t get to keep our insurance! Boo!

On the plus side, though, our new health insurance plan also includes a Health Savings Account, where we can save money for that big deductible, tax-free. The HSA can also serve as a back-up source of retirement income if we don’t use it all up on medical costs in the mean time.

Another positive change was seeing my husband’s 401k match increase. To take full advantage, we would need to double our contributions. So we did.

Between our health insurance premium increase, our HSA contributions and our increased 401k contributions, we would be losing an additional $457 from our monthly income. Ouch! Adjusting our withholding doesn’t make up for it completely (our paychecks are a little bit smaller than they had been), but it definitely softens the blow.

As far as the self-employment taxes go, I’m not too worried. I’m taking in a lot less income than I have in the past (mostly by choice). If my blog were to take off or I otherwise started to make money hand over fist, then I’d simply put away a percentage in a savings account, and pay the quarterly taxes. Or, alternatively, we could start withholding more from my husband’s paycheck again. In any case, we’ll cross that bridge if we get there.

Everyone’s situation is different, but if you get a refund at all, I hope you put it to use in a way that truly makes your life better!

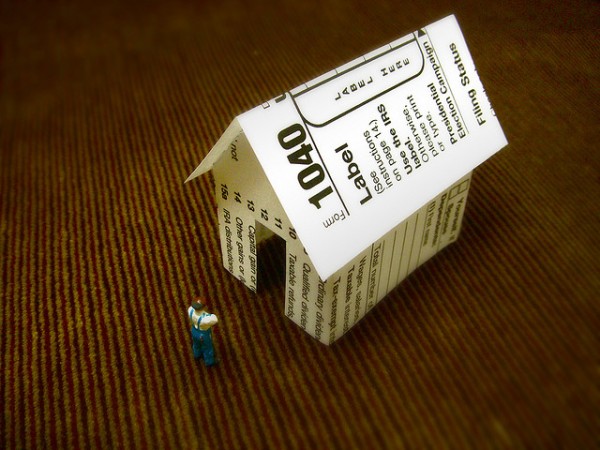

Image sources: 1040 House, Life Preserver by StockMonkeys.com, Presents

We use our little tax return to pay off small debts that we have.

Good for you, Michelle! I think a lot of people (including me at one time) see smaller refunds and figure a small amount won’t make a difference in the grand scheme of things, so they just spend it. But every little bit counts!

Jennifer,

Unfortunately, I think we are going to owe money this year 🙁 In the past, we rolled refunds straight into investments/savings.

I wish more people would follow our lead because it can add up to quite a chunk of change over the years!

I’m using my 2014 tax return to help fund my volunteer trip abroad in Peru! I try to do something like this every year because I love traveling, but I also like to put some money aside in my emergency fund, like you.

Spend your tax refund the same way you would your take-home salary, because that’s exactly what it is. All a refund is, is a return of excessive withholdings. If you spend your refund or think of your refund differently than salary (i.e. ‘found money’), you are deceiving yourself.