I’ve been on a selling spree recently.

Over the past few months we’ve been clobbered with one big expense after another. It feels like being adrift on a small boat in a stormy sea trying to ride out the big waves.

Bringing in extra income here and there has helped us bail out instead of using up (too much of) our savings, or worse, sinking further into debt. And, besides, having our house in complete disarray due to a major plumbing project has helped assign more urgency to de-cluttering.

Long gone are the nice handbags that lent an upscale air to my closet, but rarely served a practical purpose anymore. I sold some clothes and a spare dresser.

I was calculating how much the profits from some unused toys would help when my scruples kicked in and gave me pause: Were the toys even mine to sell?

I figured I had a few different options. I could sell the unused toys and use the money to help pay bills. I could sell the toys and use the money to pay for different toys (say, for Christmas). Or, I could sell the toys and give the money to my son.

One of the toys, a LeapPad, had been my oldest son’s chief birthday gift when he turned four. It was a rare gifting mistake on my part. He had enjoyed the toy when it worked, but it blew through batteries, and I rarely got around to recharging them.

It would sit for months with dead batteries, and he really didn’t miss it at all. He quickly outgrew its educational value, and it just sat, reminding me that it had been a silly thing to spend a good bit of money on (even if I had purchased it used). With its resale value rapidly declining, I wanted to sell it while I could still recoup a good bit of the cost.

I had spent the money to buy the toy, but I had given the gift to my son. Was it right to sell a gift and then use the money for his parents’ financial obligations? If we were in truly dire straits, perhaps I could justify that.

But I thought about how hard my son was working to earn money to buy new Legos. He spent hours looking at his Lego City book and frequently asked if he could do some jobs to earn money, for which I could only pay a little bit at a time.

In the end, I decided the money had to go to my son.

I told my son I thought we should sell the toy, and he didn’t resist as much as I expected — he realized that he hardly ever used it. Plus, I reminded him that he was working hard to save enough money for a $75 Lego set that he really wanted, and this would put a big dent in that savings goal.

He very quickly jumped on board with selling his LeapPad and other little-used belongings, like a tiny rocking chair he had outgrown.

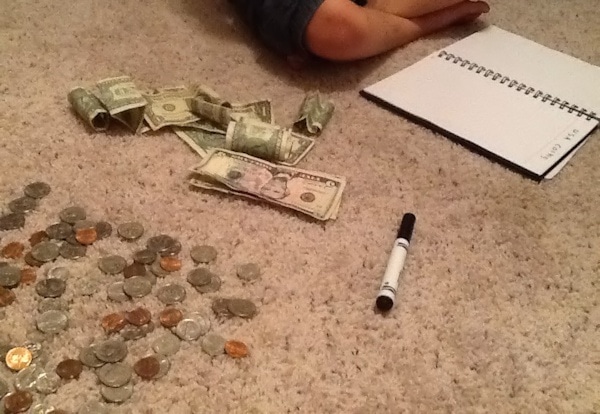

The rocking chair sold right away through a Facebook garage sale group, and my son suddenly found himself $15 richer. We took the opportunity to sit down on his bedroom floor and empty all of his various banks to count up the contents, something we hadn’t really done before.

We discussed setting 10 percent aside for charity (church or school fundraisers), and then I asked him how much he wanted to save for college, which, for some reason, has been on his mind recently. I suggested he save half, and he liked that idea.

We sorted out all of the various coins and bills, taking the opportunity to learn the names of each and how much they were worth. My son decided to tally the money in a notebook, and then we added it all up. It was a fantastic learning opportunity!

Next, we assigned a purpose for each one of his banks to keep his money more organized. The English post box is easiest to open, so we are using that one for charity — he donates at church weekly.

A little tin bank from Denmark holds a fascinating array of foreign coins passed down from Daddy, and the abundance of Canadian coins that regularly find their way into cash registers here in New York (but get spit out by coin machines).

We decided on the yellow submarine bank for savings, because it most easily accommodates a variety of coins and bills, and I like the optimism suggested by its large size. Spending money goes to the cash register, which opens only when it reaches $10. That should keep the spending money from burning a hole in my son’s pocket, so he can save it for larger Lego acquisitions instead of blowing it on more Matchbox cars at the grocery store.

Funny story: Once my son was so eager to retrieve the money out of that cash register bank, that he was a little bit overzealous adding new coins. He accidentally surpassed the $10 threshold and had to wait even longer to get his money out. Womp! Womp! He has kind of a love/hate relationship with that bank.

After counting and divvying up the money, we realized that there was exactly enough spending money to purchase the Lego City fire station, with the help of a birthday gift card my son had been saving. He was over the moon excited about achieving his goal.

The LeapPad eventually sold, so he already has a good amount of money saved toward his next goal (his masterplan is to replace his entire city and its assortment of blocks, boxes and other miscellany with Lego).

I am so glad I arrived at this conclusion about selling toys, because I had a wonderful time teaching my son about money. While I do want him to learn that saving money takes time and effort, I think it’s also valuable for him to learn about buying quality things that have some resale value, and either selling them or donating them rather than throwing them out when he’s done.

There’s something to be said for earning money by working, but selling unused belongings is also a great way to earn some extra cash.

This isn’t to say that my six-year-old has full reign over the decision-making when it comes to his toys. Mom and Dad do have the final say. He decided a few months ago that his imaginary restaurant is “for rent” because he isn’t interested in it anymore. He’s had the nice wooden play kitchen since he was 1 1/2, and over the years we’ve added all manner of pretend food and kitchen gadgets.

He would happily have sold all of that, but I told him he needs to save it for his baby brother who will soon be interested in it like he used to be. Some toys aren’t worth the hassle of selling, so we donate them instead. But, if we do sell a toy that is his, the money will be his.

I hadn’t realized what an impression all of this had left on him until a few nights ago. We had just finished reading On the Banks of Plum Creek, when my son said to me “Ma made a bad choice when she gave Charlotte away, didn’t she?”

In the book, Laura Ingalls’ family is visited by neighbors who have a rather spoiled little girl. The girl wants to keep Laura’s rag doll, Charlotte. Ma, wanting to be polite to guests, demands that Laura turn over the doll, even though it is very special to Laura.

I had to agree with my little boy, and I’m glad I decided to let him have a say in what happens to his belongings — kids are people, too!

What a great idea! As you said, sounds like the perfect learning experience. I love the different banks your son has–makes so much sense to have a physical representation of how savings work.

Thank you! Yeah, the different banks worked out perfectly. I love that each one has its own purpose now.

What an interesting question! I’ve recently started wondering if allowing my daughter to keep the money earned would make it easier for her to part with unusued toys…

I’m curious if you feel the same way about children’s clothing… My daughter is an only child, with only male cousins. As a result, I consign or donate almost all of her outgrown clothes.

For now I don’t really worry about the clothing. I don’t give it as a gift, it’s more a utilitarian thing that my kids don’t grow attached to. Plus, I keep it all for future kids, so I haven’t had to grapple with that yet. Same holds true for baby gear — I don’t feel like that belongs to my kids.

That said, I think for an older girl it would be a fantastic learning opportunity to practice decluttering the closet and then using consignment proceeds to buy new stuff! I think all of this is really a personal decision and there isn’t a right or wrong, but there is definitely a learning opportunity there.

Thanks for reading!

We do the same thing with our kids’ toys! It really helped when we did a major declutter of their bedrooms, to let them know they could make some money with the things they don’t play with anymore! (They also chose some things to donate, or give to younger cousins, if they knew they would enjoy them.) However, with larger items like bikes, that we are going to replace – we sell them on Craigslist and use the money towards their new one.

Awesome! That’s a great idea using proceeds from bikes to buy new bikes.

You’ve totally made me rethink this! I think you did the right thing, and am questioning my own selling habits in the past. Mine are so young, though, I don’t even think they grasp the whole money concept. And I haven’t gotten rid of anything they’re in love with. Justifications.

My oldest is six, and this is the first time it’s ever crossed my mind!

Once again, an example of skillful parenting, Jenn.

Thank you!

I don’t have kids but I do have 12 nieces and nephews. My family tends to give me the old toys to sell since it just takes up space. What I’ve done is save the money from the sale into different savings accounts for them. I just don’t ever share that I do.

That’s very nice of you — what an awesome uncle you are!

I hadn’t thought about all of this before, but my daughter is 5 now and as she has outgrown things, we’ve given them to Goodwill. (We just moved and we didn’t have as much time to sell as I had hoped.) We did consign some of her clothes, but – as you stated above – I consider that utilitarian. And that money just goes back to getting her whatever she’ll soon need. However, there will be some larger toys that she will soon outgrow that I would love to sell and give her the money from. She’s an avid saver, though we don’t do much with actually doing chores. This is my first time on your site, and I haven’t gotten to poke around much, but I wonder if you’d share what your son does to earn money? You mentioned that it doesn’t happen all that much, but I’d love some tips. Thanks! (P.S., She has just gotten into Legos, and while I love them, I had a bit of a sticker shock, too, when it came to actually getting her some!)

Thanks so much for checking out my blog! So far I have been bad about doing any kind of regular allowance for my oldest, or even having a regular list of chores for him to do. I’m working on that this year. Some of the jobs he has done to earn some spending money have been yard work (picking up sticks, raking leaves), folding laundry, loading or unloading the dishwasher and even cleaning the whole living room. A lot of the time he comes up with his own ideas and then I tell him whether or not I’m willing to pay. I do NOT pay him for things like brushing his teeth, making his bed, putting his dirty laundry where it belongs, etc., because those are all things he should be doing anyway. I want him to understand that there are certain responsibilities we all have that don’t come with a monetary reward. Paid work is something that has a mutual benefit.

Yeah, Legos are so pricey, but in my opinion are worth every penny! They’re high quality, the attention to detail is outstanding and they let kids use their imaginations. I love them! It’s hard to find deals, but sometimes you can find good Lego sets on Amazon Warehouse Deals and shopgoodwill.com.

What a wonderful lesson in money for your son. Encouraging him to give to charity at such a young age and save up enough to buy his own toys is such a valuable thing to do, because you’re embedding the right kind of money habits early on. Thank you for sharing!

Thank you, Hayley! I hope all of this pays off down the road.

Nice one Jen! I should try this one for my daughter at the young age, you already teach your son to be financially responsible.

Thank you! I’m trying!

You know, I plan on doing this with Baby Bun too. Selling things off like toys he doesn’t use.. except he doesn’t have much in way of toys yet, so.. 🙂

I love that nickname Baby Bun 🙂

Gah I never thought about this. I read a lot of personal finance posts related to children and it makes me even more apprehensive about having my own. So many things you need to decide! I think I would let my kid keep the money, mainly because it might help them learn the value of money and motivate them to make more of it.

Aw, it’s not as complicated as it might seem, really! Just follow your instincts and do your best. Becoming a mom was my motivation to embrace frugality and learn about money — it was a great change. Thanks for stopping by!

Selling toys to get new toys is something I would definitely do. No guilt and they are getting what they want still! You shared great ideas.

We told our daughter during last christmas there was a limit on the number of toys allowed in the house and that if she received 5 new toys she needed to give away 5 new toys. We said there were kids that didn’t have any toys and asked her if she would want to give her toys to kids that didn’t have any. At first she said no which made me laugh, but then she came back and decided to give away more than 5 which was a pretty cool family moment. Sometimes the lessons sink in, but it takes a few tries. Thanks for sharing!

That’s a great way to keep toys under control, and how nice that your daughter decided to be extra generous. Thanks for stopping by!